Global Trends and Investment Projections for 120562102, 9055686970, 645492658, 6971941419, 4075830846, 3301007477

Recent analyses highlight a substantial shift in global investment trends, particularly favoring technology and renewable energy sectors. Assets such as 120562102, 9055686970, 645492658, 6971941419, 4075830846, and 3301007477 are positioned to benefit from this transition. Investors must navigate the complexities of market dynamics and associated risks. Understanding these factors could clarify the path forward in an increasingly competitive landscape. The implications for long-term strategy are profound.

Overview of Key Identifiers and Their Significance

In the realm of global investment, key identifiers serve as critical benchmarks that inform stakeholders about market dynamics and economic health.

Their significance analysis allows investors to evaluate risk, gauge potential returns, and make informed decisions.

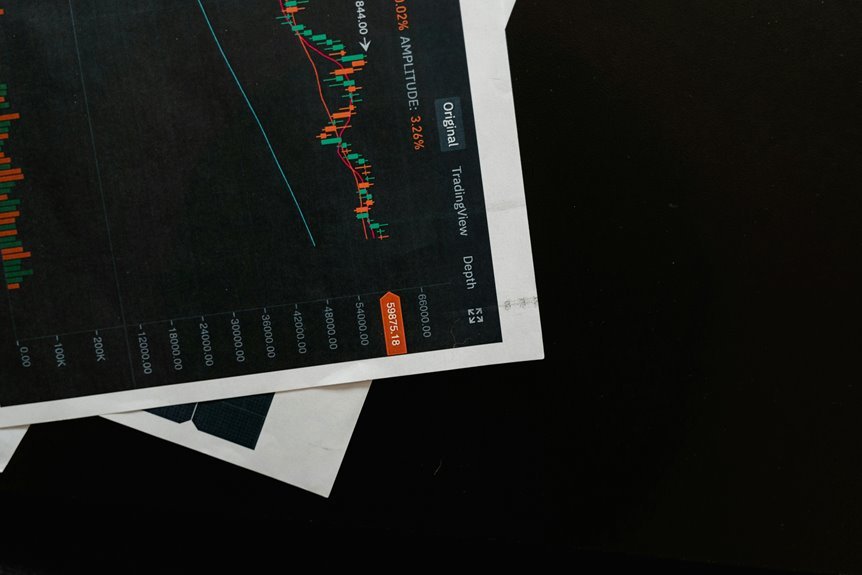

Current Market Trends for Selected Sectors

While various sectors exhibit distinct trajectories, current market trends reveal a notable shift towards technology and renewable energy as primary drivers of growth.

Sector analysis indicates that these areas outperform traditional industries, influenced by favorable economic indicators and evolving market dynamics.

Investment strategies increasingly prioritize these sectors, with performance metrics reflecting robust returns, highlighting a transformation in investor preferences and aligning with current trends in sustainability and innovation.

Investment Opportunities and Risks

The growing emphasis on technology and renewable energy not only presents significant investment opportunities but also introduces a range of associated risks.

Sustainable investing in emerging markets requires thorough risk assessment, as economic indicators fluctuate.

Technological innovation can enhance portfolio diversification, yet investors must remain vigilant about potential volatility.

Balancing these factors is essential for navigating today’s complex investment landscape effectively.

Future Projections and Strategic Considerations

As global markets evolve, projections indicate a shift towards increased integration of technology and sustainability in investment strategies.

Future scenarios suggest that firms prioritizing these elements will enhance their competitive edge.

Strategic planning must adapt to these trends, incorporating data analytics and environmental considerations.

Investors should remain vigilant, as agility in response to these developments will be crucial for long-term success and resilience.

Conclusion

In conclusion, the investment landscape for identifiers 120562102, 9055686970, 645492658, 6971941419, 4075830846, and 3301007477 reflects a broader shift towards technology and renewable energy. As firms embrace sustainability and innovation, they position themselves for competitive advantage. However, with opportunity comes risk, requiring careful analysis and strategic foresight. Investors must navigate market dynamics, anticipate fluctuations, and adapt to evolving trends to ensure long-term success in this rapidly changing environment.